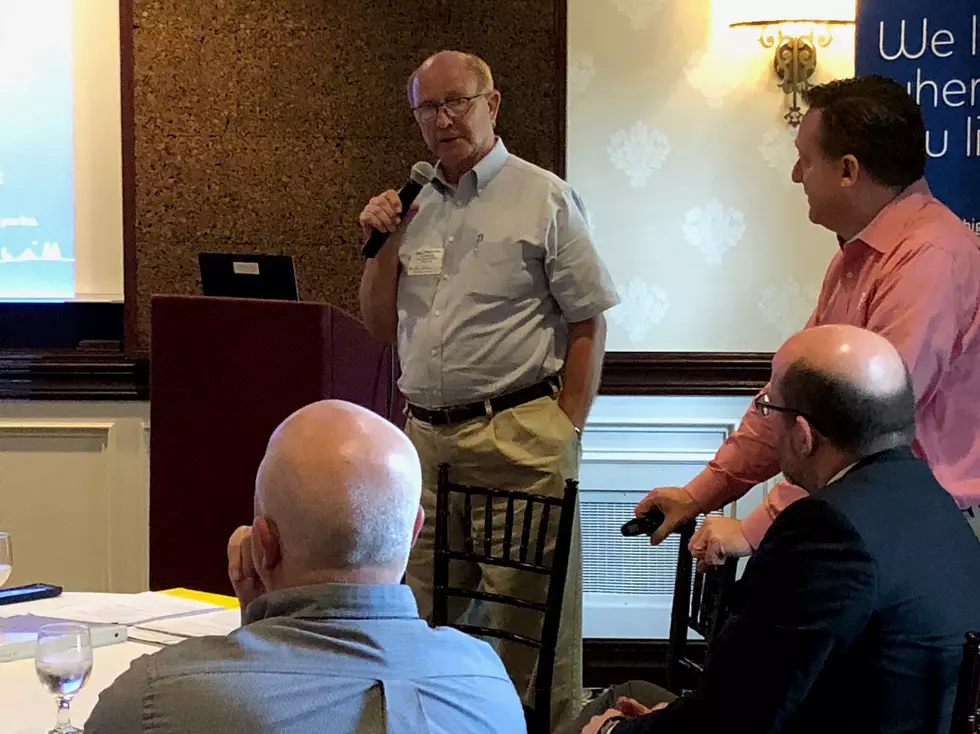

Rep. Maturen talks about importance of fair property tax system with Michigan Municipal League

State Rep. David Maturen continues to advocate for fair property tax assessments for Michigan businesses and residents.

Maturen this week appeared as a special guest at a Michigan Municipal League legislative update in Marshall. The forum, attended by several local government and community leaders, focused on tax policy.

Maturen is vice chair of the House Tax Policy Committee, and has worked in real estate appraisal and valuation for decades. He continues to push for “dark store” property tax reforms and other changes to address problem areas, while raising concerns about proposals he says are unnecessarily broad.

“Michigan’s economic comeback has been sparked in large part by smart and sensible tax reforms,” said Maturen, of Vicksburg. “We must continue on the right path moving forward.

“The assessed value of property and the amount of taxes paid as a result are critically important to us all. It is a key factor in determining the financial health of homeowners and small businesses. It is a key factor in financing local governments and schools. The property tax system must be fair and equitable for all, and that is the measure I use to judge proposed changes.”

Maturen has championed several important tax changes, including a recent improvement signed into law by Gov. Rick Snyder in June. The change provides equity on the real estate transfer tax.

Maturen continues to fight for his “dark store” legislation designed to prevent large retail corporations from “unfairly and dramatically” reducing their property tax bills. Maturen said his legislation would mirror a Michigan Supreme Court ruling from late 2017, ensuring fairness for small retailers and local communities.

Maturen also is monitoring a more sweeping proposal to change the state’s property tax assessing system, which has sparked some concern.

“I believe we should address specific problem areas without revamping our entire system or taking away local control,” Maturen said.

More From WBCKFM