Michigan Gas Tax Going Up January 1, 2022

I just published a piece last Friday titled “Michiganders Are Getting Buried By Inflation Here Are Some Examples”. Now we find out that the State of Michigan will be increasing our fuel tax via a cost-of-living increase starting on January 1, 2022.

The Mackinac Center for Public Policy’s Michigan Capitol Confidential has informed us of the New Year's gift. House Bill 4738: Increase gas and diesel tax Public Act 176 of 2015 was passed in 2015 and with that bill came an inflation-based trigger. That bill also brought us the 7.3 cents per gallon tax increase and a very large increase in annual vehicle registration/license plate fee/tax.

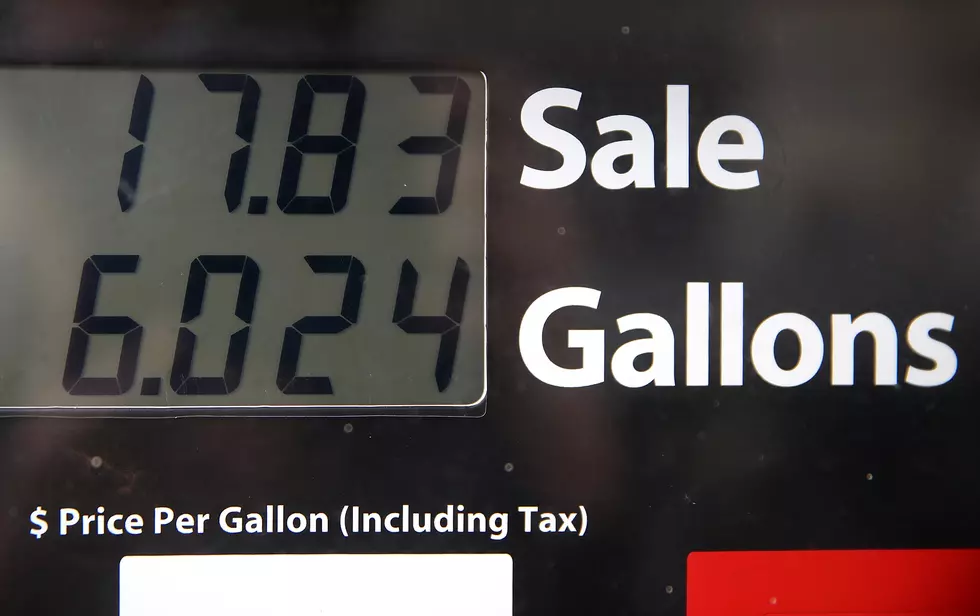

How much will this increase cost us? If the rate of inflation is 5% or higher our State gas tax will increase from 26.3 cents to 27.7 cents per gallon. Right now inflation is running at approximately 5.8%.

What are we paying right now per gallon in Michigan gas tax?

- The federal gas tax is 18.4 cents per gallon

- the state gas tax is 26.3 cents per gallon

- You also are privileged to pay 6% State sales tax.

If a gallon of gas costs $3.20 you would be paying 18.4 cents federal tax plus the 26.3 cents state tax and an additional 17 cents in Michigan sales tax. This would bring your total gas tax bill to 61.7 cents per gallon. That ranks Michigan as the 10th highest tax per gallon of gas in the nation.

Welcome to Michigan!

More From WBCKFM