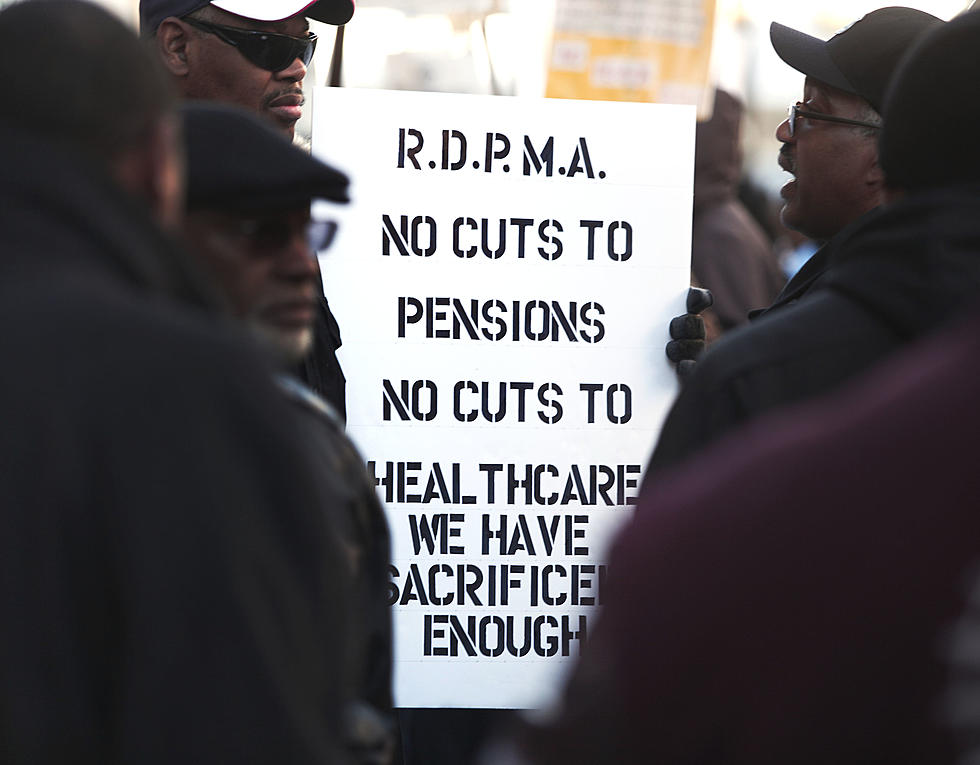

Should Taxpayers Bailout Private Unions Pensions

Yesterday on my show, The Live with Renk Show, a retired Teamster called in and discussed the Central States Fund and how his Teamsters Union promised their pensions funds would be adequately funded for exchange of a lower hourly raise. Apparently they did not hold up their part of the bargain and now the Teamster are coming crying with their hands outstretched to the taxpayer.

The Central State Fund is a Multiemployer Pension Plan. What is a Multiemployer Pension Plan? These plans are popular in the trades such as building and shipping, where union workers may work under contracts for different companies throughout the course of their careers. Under each contract funds are supposed to be deposited into the Central State Fund for the Union workers pension.

As reported by the Washington Free Beacon the Teamsters Union has some of the largest liabilities in the country within its retirement plans. One of their funds is the Central States Fund and it apparently has racked up so much debt that if it where to go under it would completely wipe out the Pension Benefit Guaranty Corporation (PBGC), an independent agency that handles bankrupt retirement plans.

The Teamsters union said in an email to their members:

There is a pension crisis in this country and Congress must resolve it as soon as possible to protect workers and our economy…We need the constituents of these Committee members to reach out to encourage their congressperson(s) to adopt the Butch Lewis Act and to take action as soon as possible.

These are private unions that through collective bargaining made their deals with private companies, why would anyone think it would be sane for the taxpayer to have to bail out their mismanagement of the funds and apparently bad deal making.

Another question is: should the government be involved with bailing any private company or pension fund out?

Your thoughts.