State Rep. Hall Moves To Protect Small Businesses From Tax Hikes

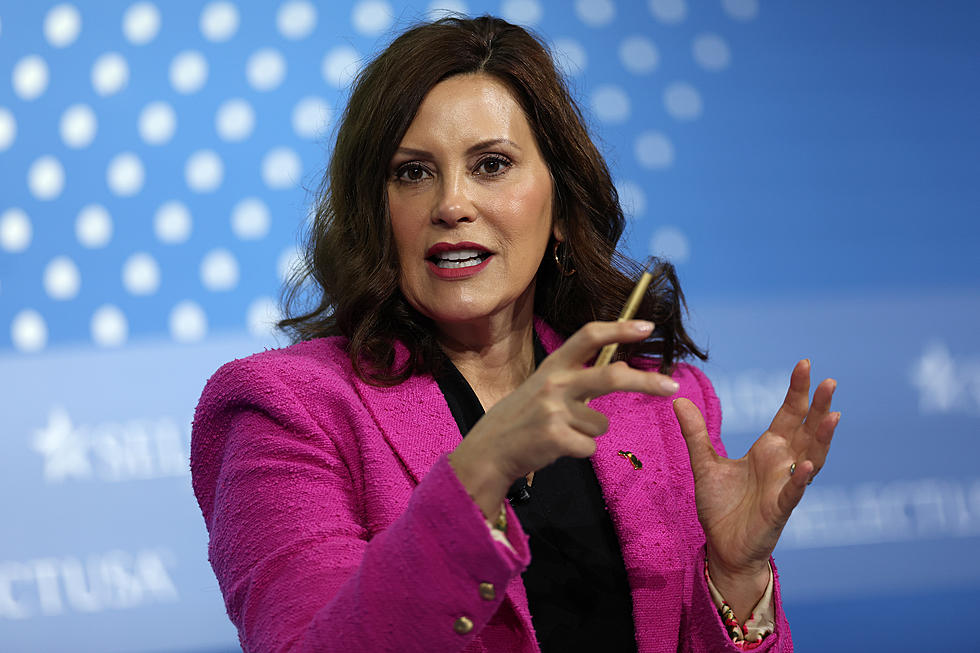

Marshall Republican State Representative Matt Hall is introducing legislation at the state capitol designed to help protect small business owners. Hall says the idea is to prevent businesses from being forced to pay higher taxes after Gov. Gretchen Whitmer used Executive Orders powers to close them. As the COVID-19 virus outbreak developed, the Governor issued executive orders which closed small businesses throughout the state. With no way to make a living following those orders, unemployed workers were paid from UIA’s trust fund – financed completely through state and federal unemployment insurance taxes.

At the start of the outbreak, the Trust Fund contained $3.9 billion – the third-highest total in the nation. But a surge in claims dropped the fund below $2.5 billion, automatically triggering a law that allows the state to implement a tax increase for small businesses in the next calendar year to replenish the funds. Hall’s legislation suspends the trigger when the fund falls during an emergency where businesses are forced by the state to close. Hall says, “This is an extremely unfair position for our local businesses to be put in. Many family businesses were struggling to get by during the shutdown because they were unable to generate income through no fault of their own. Some are still unfairly closed because of the governor’s orders when they have shown they can reopen safely and responsibly. Now they are being penalized further by being forced to contribute more of their hard-earned dollars.”

Hall says it’s concerning that the state is resorting to hiking taxes when the unemployment benefits agency also announced around the same time it had overpaid about $8 million in duplicate unemployment payments. The agency, says Hall, is also potentially liable for hundreds of millions of dollars in fraudulent payments. Hall says the state’s unemployment agency should get its own affairs in order before reaching out to the backbone of our communities for more money.

Protesters at the Capital in Lansing

More From WBCKFM