Battle Creek’s Terris Todd Talks About the School Choice Now Act

A few weeks ago, U.S. Senators Tim Scott and Lamar Alexander introduced the School Choice Now Act a bill that would redirect some corona-virus-relief funding to school-choice programs, so families could continue sending their children to the schools that are best for them even during the pandemic and recession.

In addition to a one-time emergency infusion of capital to scholarship-granting organizations that would pass the money on to families to fund their children’s schooling, the bill also creates a permanent federal tax credit for donations to non-profit scholarship-granting organizations.

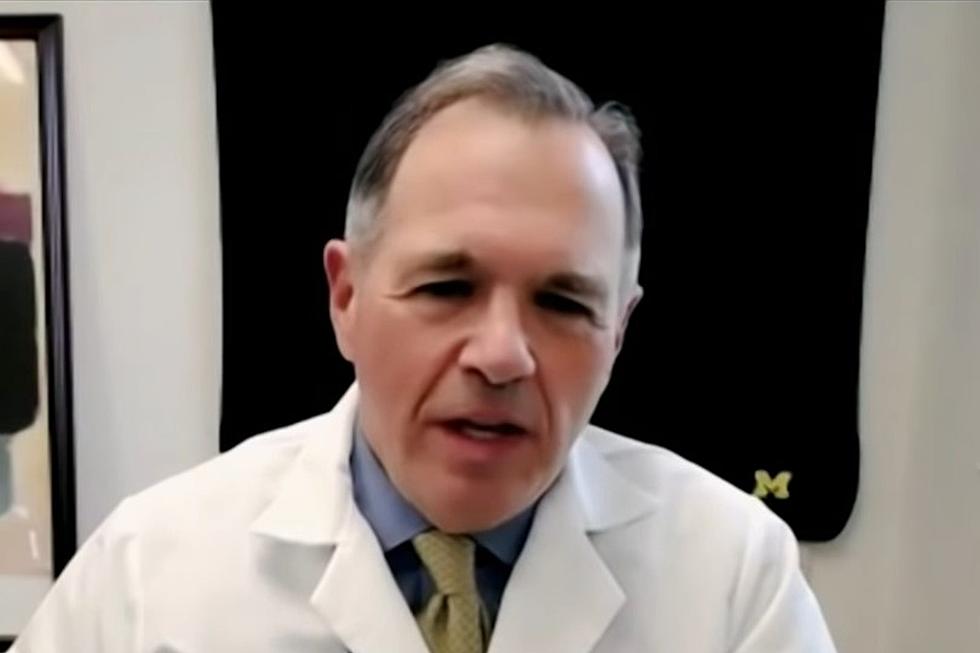

Battle Creek’s Terris Todd, Executive Director of the White House Initiative on Educational Excellence for African Americans in the Department of Education was a guest on the 95.3 WBCK Morning Show with Tim Collins on Monday.

Todd said “What School Choice does is give parents choice. It gives power back to the parents, who are the taxpayers. The Education funding should ultimately follow the student, no matter the school setting. If a student’s assigned school refuses to reopen this fall, families should have the option to take the funding set aside for their child’s education to find an alternative that will educate their child full-time.”

Todd talked about his school situation growing up in Battle Creek, and now with his children. “My brothers and I lived in the Battle Creek Public School district, but my mom chose to send us to Pennfield Schools. Now, as a parent, my wife and I were truly blessed to have that choice. Our oldest daughter is a proud Battle Creek Central Bearcat and a Math-Science Center student, and our other two daughters are Pennfield”.

Todd talked about the School Choice Now Act, which was introduced in late July. “It provides a one-time, emergency appropriations funding for scholarship-granting organizations in each state. Scholarship-granting organizations would be authorized to use the one-time funding to provide families with direct educational assistance, including private school tuition, home-schooling expenses, out of district transportation, tutoring, Special-Ed services, dual enrollment, apprenticeships and much more.”

Todd said parents could choose the academic instruction that works best for their child. He said the bill would provide permanent dollar-for-dollar federal tax credits for contributions to scholarship-granting organizations, capped at $5 billion per year. And it would allow states to create their own tax credit scholarship program that works for the unique needs of students in their state.

“It also would prohibit federal control of education to ensure that all education providers may be able to participate without fear of federal control”, said Todd.

The bill is currently working its way through the U.S. Senate and has some steps to go. “It’s gaining momentum. I believe Senator Tim Scott is optimistic about it, and I believe he does have some bipartisan support.” The Senate bill would need approval in the U.S. House of Representatives. Todd says the President would sign the measure into law.

UP NEXT: 10 Signs That Michigan Will Have an Awful Winter

More From WBCKFM